— We take our content seriously. This article was written by a real person at BREL.

This year, we asked our agents and mortgage partners to tell us what they think will happen in the Toronto real estate market in 2019. Here’s what they said:

First up: Mortgages

There could not have been a more stressful year in mortgage lending than 2018. We saw the poorly-named-but-effectively- challenging stress-test kick in for all applicants* (almost) as of January 1st 2018, which limited buyers to 5x income – down from 7x income in the past. That, coupled with a big bump up in both fixed and variable interest rates meant that it was more expensive to borrow, refinance and renew your mortgage in 2018, and, more difficult.

Overall, the stress-test is still working its way through the market. It’s too early to tell if it will have a significant impact long-term but with housing sales down to ten-year lows in 2018, in Toronto, clearly, it along with rates have both had a significant impact on mortgage borrowers.

2019 is starting off a little different (better?).

Let’s start with why it’s different:

Interest rates will not likely change (by much, if at all) in 2019. Unlike a short while ago (3 months!) when we all thought we’d see 2-3 more jumps in Prime Rate in 2019, now we’re looking at potentially no rate increase to (gasp!) even maybe a cut in prime rate (I don’t believe that – no way).

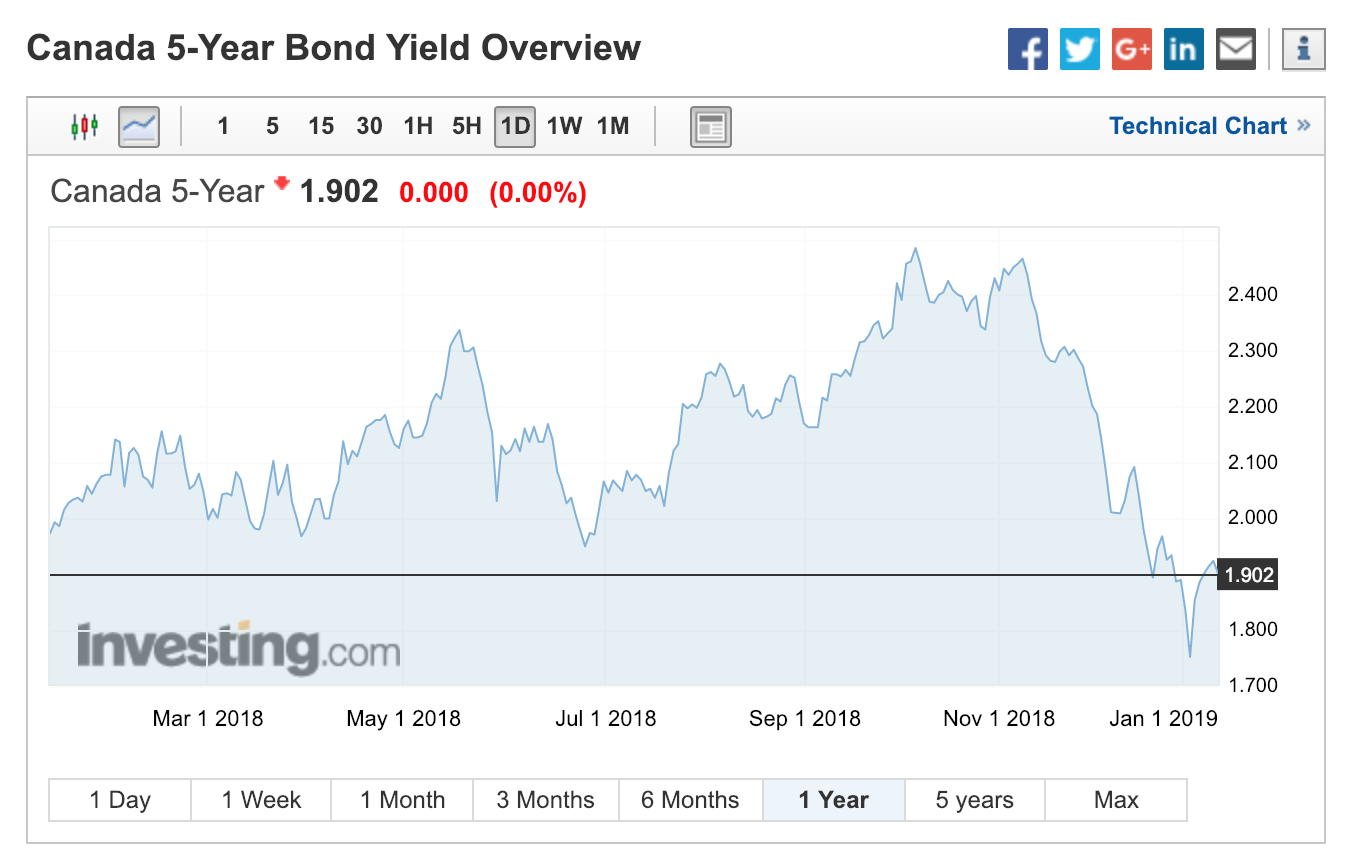

Fixed-rates should start dropping. SHOULD being the key word. Here’s why: The bond market (5-year bond yield) dictates the rise and fall of rates, and it has literally dropped like a stone.

Here’s the chart showing the 1-year trend of the bond yield.

However – due to the oligopoly in Canada with banks, rates have not yet fallen because of profit-taking on their part. The argument here is – at 2.19% 5-year fixed they were making no margin, so let’s take some margin now when rates should be about 3.5, but continue to be 3.8-3.9. In due time, they’ll drop. It just takes one bank to make a significant cut and we know that these things usually happen to spur on a spring market.

We’re not expecting any housing policy changes. There’s less talk (no talk) about housing policy changes except MAYBE HELOCs (home equity lines of credit). These are still the lowest hanging fruit for OSFI (the mortgage rule policy makers). There’s talk we may see more limits on issuing HELOCs and we have already seen a major change in how banks look at borrowers who already have existing HELOCs (and those changes weren’t pretty).

So does this mean things are better or just different than 2018? Well, the problem is – when the Bank of Canada tells us that growth is slowing and things are reversing course, OVERALL that’s not good “for Canada”. There’s small chatter in the news lately about the R-word: recession. One indicator that is accurate 66% of the time, is already predicting this might occur in the next little while. Although interest rates may not be going up (and that could be a good thing), if the economy starts to contract, overall that’s very bad for the long-term. The general thinking with rates is – if we’re at high capacity, people can afford more debt. The numbers thus far are showing that wage growth isn’t rising as much as the economy is growing, so rising rates are having a bigger impact on people’s day-to-day budget.

Enough of that negative talk! Overall, 2019 has started off on a much more positive note. The market is (mostly) balanced. Interest rates don’t look like they’ll be going up much in the short-term. We’re not expecting any more (major) changes in lending policy (for the negative) and, 2019 just happens to be a Federal Election year. What does that mean? Expect the three major parties to make housing policy a strong pillar of their election mandates.

Next up: BREL Agent Predictions

Next up: BREL Agent Predictions

The Transfer of Wealth from Boomers Accelerates

From Lisa: “While the Bank of Mom and Dad has been a thing for a while, I’m absolutely seeing the boomer transfer of wealth accelerating (you can read more about that in this article). It’s no longer just a cultural thing where parents help out kids but parents looking to park their kids’ inheritances in advance in a home. They even come out and say “we would rather help now, than when we’re dead”. If you’re looking to help your kids get into Toronto’s real estate market, click here to read a blog we wrote Helping Your Adult Kids Buy a Home.

Laneway Houses Will be the Next Big Thing

From Halina: “My prediction for 2019 is trend focused…I anticipate that we will be seeing a lot of new laneway housing and homes for sale being marketed with the potential for laneway housing. I would caution all buyers to do their homework first to ensure that this is a possibility because restrictions do apply and the cost can be quite hefty. There are a lot of great online resources available to answer questions but this is a relatively new development so as always, do your due diligence and connect with an industry professional.”

Hot ‘Hood Alert: the LRT – Eglinton

From Matt: “My prediction is that the homes in the west end surrounding the LRT – Eglinton west will skyrocket in value once it is complete in 2020. This is the area I would concentrate on for investment and there are lots of opportunities to find affordable starter homes there too. Watching the neighbourhood gentrify over the next 5-10 years will be both exciting and good for the pocketbook.”

Affordability Will Still Suck

From Jenny: “I predict affordability will continue to be a hot topic for anyone looking to make a move this year in Toronto. Rising interest rates, stress tests and other government intervention do have an effect, but they are no match for the basic economic principles of supply and demand — of which there’s a huge imbalance in this city.”

Condos, Condos, Condos

From Tyson: “Price increases in the condo market will outpace increases in the house market, as first-time Buyers and investors continue to flock to condos. End users will choose central locations and amenities over size, and investors will take advantage of the frenzied rental market and easing landlord restrictions. The elusive detached house will remain a dream for first-timers, but with new condos becoming more family-friendly, downtown living is still possible.”

Hot ‘Hood Alert: East of the Don

From Allie: “East of the Don River a hive of activity is happening along Queen St East with a smattering of under construction boutique mid-rise condo/townhouse developments shooting up, which will all help with gentrifying Leslieville that little bit more. Some great boutique stores and independent coffee shops for locals to work, plus amazing farm-to-table restaurants will help to attract Millennials and those looking for a quieter life just outside the city centre. First-time buyers who are looking to enter the real estate market will find very reasonably priced units and only a 20-minute streetcar ride downtown, or an even quicker bicycle ride along Dundas St E’s bike lanes. A great alternative to Liberty Village.”

It’s a Landlord’s Market

From Dena: “The rental market in 2019 will continue to be strong as vacancy rates hover around 0.5%. Recent interest rate hikes coupled with changes to financing requirement means people are continuing to rent vs buy, so demand is strong…and with renters renewing their leases vs moving, supply is restricted too. In 2019, we’ll continue to see multiple offers for rentals in great buildings and locations, and having great credit, verified income and an experienced agent working in your best interests will be critical for success.”

Look East!

From Brendan: “My annual predictions are usually focused on the gradual evolution of the city, as neighborhoods evolve and gentrify, demographics shift and new development change the face of Toronto… or expands it into previously empty corners or forgotten hoods. Get in ahead of the curve and buy in the NEXT big neighbourhood.

My trend to watch for 2019 and beyond is the continued evolution of the south-east of the city; for a lifetime the area east of Church around King, to the waterfront east of Queens Quay and the land hugging the south Don river have all been underutilized at best, and an industrial eyesore at worst. That is all about to change.

Google’s Sidewalk Labs (check it out here) is one of the highest profile projects. The previously contaminated land east of the Distillery District to the Humber River has already mostly completed its transition to a real neighbourhood with condos and services. Jilly’s completed its transformation into the hip Broadview Hotel, and the zone along both sides of the DVP continues to fill in. Huge developments are starting at the south end of Broadview where it ends, and new buildings continue to come online in the Portlands around Corus Quay and sugar beach.

These might have snuck up on you…but I predict that 2019 is the year they hit many people’s mental city maps. Get in now!

PS my earlier prediction about Dupont becoming cooler have definitely come true, and the Lower JCT is well underway along Sterling Road! …sadly, I’m still waiting for one of my favourite predictions: the Value Village at Bloor & Landsdowne… is still chugging along!”