My annual ‘Real Estate Year in Review’ blog is one of my favourites to write. But how can I possibly capture 2022?

It was the best of times. (January-March)

It was the worst of times. (April-July)

It was the ‘weirdest and hardest-to-predict’ of times. (August-now)

Here’s a look back at the major real estate news stories from 2022 and how it impacted Toronto buyers and sellers:

The Big Story: Inflation and Interest Rates

While Canada’s inflation rate has hovered between 1-3% for the last 20 years, it started to accelerate in the fall of 2021. Pent-up demand for goods and services after months of lockdowns meant Canadians were ready to spend: they were going to restaurants again; they were travelling; they were upgrading their homes and lifestyles. The media called it ‘revenge living’, and it felt good! Normalcy seemed SO CLOSE.

But the supply chains couldn’t keep up. COVID was still a problem in China, where so many of our goods are manufactured. Russia declared war in Ukraine. The price of gas shot up. Food prices started to climb. Suddenly butter was $8.99 and finding a head of romaine lettuce under $7 was such a feat that you texted your friends to brag about it.

In August 2021, inflation was over 4%; by March 2022, it had skyrocketed to 6.7%, where it continued to increase, finally peaking at 8.1% in June 2022.

Historical Inflation Rates: Canada

| Year | Jan | Feb | Mar | Apr | May | Jun | Jul | Aug | Sep | Oct | Nov | Dec | Annual |

| 2022 | 5.1% | 5.7% | 6.7% | 6.8% | 7.7% | 8.1% | 7.6% | 7.0% | 6.9% | 6.9% | 6.9% | ||

| 2021 | 1.0% | 1.1% | 2.2% | 3.4% | 3.6% | 3.1% | 3.7% | 4.1% | 4.4% | 4.7% | 4.7% | 4.8% | 3.4% |

| 2020 | 2.4% | 2.2% | 0.9% | ‑0.2% | ‑0.4% | 0.7% | 0.1% | 0.1% | 0.5% | 0.7% | 1.0% | 0.7% | 0.7% |

It’s never good when the cost of goods increases faster than wages, so the Canadian government set out to tame inflation with their (historically) most effective tool: interest rates.

In March 2022, they increased the Bank of Canada’s overnight interest rate from 0.25% to 0.5%…and they did it again, at every opportunity, in April, June, July, September, October and December, ending the year at 4.25%.

Adding fuel to the fire: the mortgage stress test rate remained unchanged in 2022, meaning that borrowers still had to qualify 2% higher than actual interest rates in order to get a mortgage.

The Other Big Story: Impact on Prices and Sales Volume

While we didn’t know it at the time, the first few months of 2022 signalled the end of one of Toronto’s most frenzied real estate markets. Motivated post-COVID homebuyers, near-record low interest rates, low inventory levels of homes for sale and fierce bidding wars combined to drive prices to unprecedented levels.

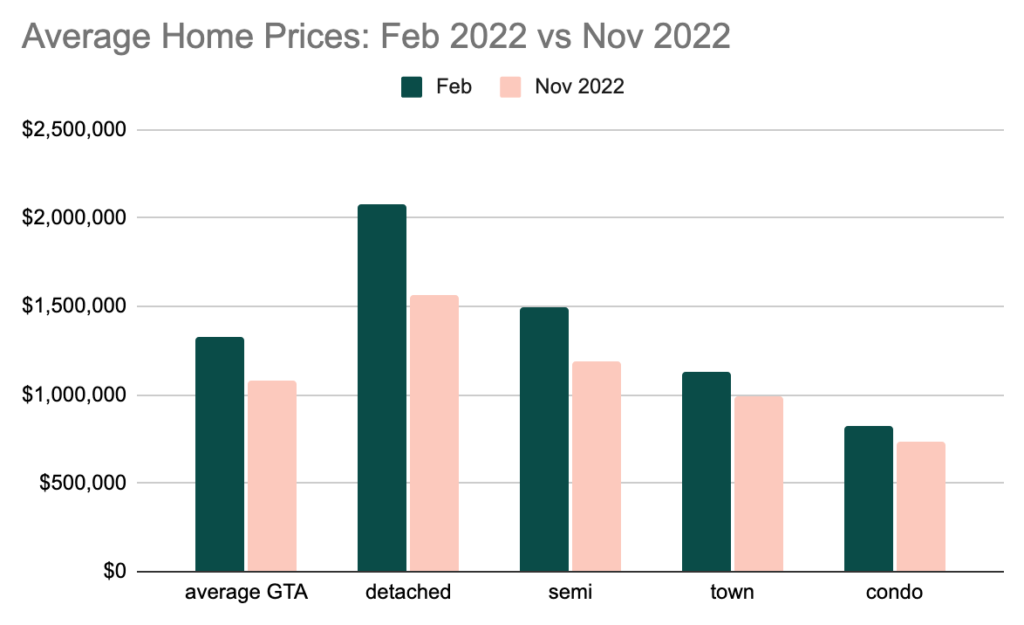

In February 2022, average prices peaked at $1,332,000 across the GTA. That month in Toronto, average prices looked like this:

- Detached house: almost $2.1 million

- Semi-detached house: $1.5 million

- Townhouses: over $1.1 million

- Condo: $822,000

Nobody thought that level of activity would last…but few were ready for how quickly the market shift happened in Toronto. With every increase in interest rates, we saw the volume of sales decrease, along with average prices.

By November 2022 the average price of a home in the GTA was $1,079,395. In Toronto, prices looked like this:

- Detached house: a bit more than $1.5 million

- Semi-detached house: 1.2 million

- Townhouse: $995,000

- Condo: $735,000

The record-breaking pace of the first few months of 2022 was quickly reversed, with monthly sales volume plummeting near 50% for the remainder of 2022. By November 2022, 43,658 fewer homes were sold in the Greater Toronto Area than in 2021 – a 37% decrease in the annual volume of sales.

Interestingly: Most of the negative impact on home prices in the GTA happened between March and July 2022; since then, prices have been relatively stable.

Also interesting: In most downward real estate market shifts, we usually see low buyer demand coupled with an increase in the supply of inventory (in other words, more homes for sale) – and that results in lower prices. But that’s not what happened in 2022.

We experienced lower buyer demand – but the inventory of homes for sale remained stubbornly low throughout the year. Despite the market shift, Toronto had less than 2 months of inventory for sale in November. That’s important because traditionally, less than 4 months of inventory is indicative of a seller’s market. While nobody is arguing that the sellers are actually in control of the current market, it’s yet another oddity of the 2022 real estate market in Toronto.

So why was inventory so low?

Real estate veterans like us weren’t really surprised by the continued low inventory – we saw the same thing happen during the downturns of 2008, 2017 and 2020. Time and again, Toronto homeowners have shown their resiliency and confidence in the long-term appreciation of the real estate market. They consider themselves fortunate to own a home here and don’t want to sell it at a discount unless they need to sell.

We’re 10 months into this market shift, and we haven’t really seen a lot of ‘need to sell’ sellers who can’t afford their homes. The ‘need to sell’ sellers of 2022 were largely made up of people making lifestyle moves, prompted by births, deaths, marriages, divorces and people moving in/out of the city.

So even as buyer demand slowed throughout the year, without a noticeable increase in inventory, the impact on prices was minimal after the initial drop.

How Inflation, Higher Interest Rates and Lower Prices Impacted Buyers in 2022

While average home prices decreased in 2022, that doesn’t mean buying a home in Toronto became more affordable. The higher interest rates impacted buyer purchasing power, meaning they weren’t able to qualify to borrow as much mortgage as they could have in early 2022. The new, lower budgets meant homebuyers had to make new compromises – and some were priced out of the market completely, unable to find a home within their new budget.

Buyers who were successful in purchasing in 2022 also had to contend with higher mortgage payments. In March 2022, the monthly payment on a $500,000 mortgage at 3.45% (the prime rate in March) was $2,483. By December 2022, the monthly payment on a $500,000 mortgage at the prime rate, now 6.45%, cost $3,334. That’s more than $840 more a month – or 34% more.

The You-May-Have-Missed-it Stories

2022 saw unprecedented levels of provincial and federal government regulation.

Increases in the Non-Resident Speculation Tax

The Non-Resident Speculation Tax (NRST), first introduced in the Greater Toronto Area in 2017, was increased from 15% to 20% and expanded to include all communities in Ontario. In October 2022, the non-resident speculation tax was further increased to 25% across Ontario. This tax impacts any individual who is not a Canadian citizen or Permanent Resident.

2-Year Ban on Foreign Buyers

As part of the 2022 budget, the Government of Canada announced a measure to prohibit non-Canadians from purchasing residential property in Canada for a period of 2 years, starting January 1, 2023. On June 23, 2022, Parliament passed the Prohibition on the Purchase of Residential Property by Non-Canadians Act…and we have heard basically nothing since.

A blatantly political piece of legislation, (given data that foreign buyers represent a very small portion of purchases) critical details regarding implementation have still not been released as of writing (December 19, 2022!), leaving both the public and even the real estate industry in the dark as to how this new law will be applied in practice.

What We Do Know:

- Does not apply to Canadian citizens and permanent residents.

- Applies to non-Canadians directly or indirectly purchasing residential property in Canada for a period of two years.

- Applies to residential property, including detached houses or similar buildings of one to three dwelling units, as well as parts of buildings such as semi-detached houses, condominium units, or other similar premises.

- Applies to direct or indirect purchases of residential property, including purchases made through corporations, trusts or other legal entities.

- Establishes penalties for non-compliance applicable to non-Canadians, as well as any person or entity knowingly assisting a non-Canadian in violating the prohibition. [To the tune of $10,000!]

It is also said that spouses of Canadian citizens or permanent residents would be exempt from the ban.

As of now, the government has still not released supporting regulations for the law, meaning no details regarding definitions, exceptions, or enforcement have yet been made public to help individuals understand and comply with the law.

As you can imagine, even the Canadian Real Estate Association is annoyed. Hopefully, more details will be forthcoming before the ban actually takes effect.

More Homes Built Faster Act

In October 2022 came another politically-necessary announcement: Doug Ford’s eye-rollingly named More Homes Built Faster Act, a sweeping plan to construct 1.5 million homes in Ontario by 2031, including 285,000 homes in Toronto. It aims to accomplish this via a host of policy and regulation changes, including decreasing development charges, making the approval process easier for smaller projects, and zoning regulations to increase density–among other things.

While these measures will likely help promote more construction and increase density, it comes at a cost…and is not at all guaranteed to work. Construction levels are already at capacity and bursting at the seams as it is, so many are asking how it could be ramped up without an influx of new labour. And two areas to be slashed to accomplish these goals include heritage designations and environmental protections–not exactly the kind of changes that make Ontario more livable.

Another objection comes from Ontario’s municipalities themselves: in cutting fees to encourage builders, they say this means funds used to pay for roads, sewers and transit around new housing will dry up. “Either they’re going to have to find revenues from other places, or they’re going to have to cut back on services. And neither of those are very appealing options,” said Matti Siemiatycki, a professor at the University of Toronto who focuses on urban issues.

Here is the full text of the More Homes Built Faster Act, 2022,

Vacant Home Tax

In the federal 2022 budget, the Trudeau government proposed a tax on foreign-owned homes left vacant. However, some municipalities moved faster and are already implementing their own vacant home taxes, including the City of Toronto. Starting in January 2023, all residential property owners in Toronto or Ottawa are required to declare the status of their property annually, even if they live there. If it’s vacant for more than 6 months of the year (and is not exempt for an allowed reason), it will be subject to a tax. Peel region is also in the process of implementing its own tax as a district. Details of each program are specific to the municipality.

So What’s Next?

We’re actually feeling pretty optimistic about 2023 and can’t wait to tell you all about it…but first, we have some gifts to unwrap, some turkey to eat and some family to host – at last – after a two-year holiday hiatus. Happy holidays!