— We take our content seriously. This article was written by a real person at BREL.

As we age, we often find ourselves navigating various life transitions, including downsizing or selling our homes. Unfortunately, scammers see these transitions as opportunities to exploit seniors. Real estate scams targeting older adults are on the rise, but with the right knowledge and precautions, you can protect yourself and your home. Below, we explore common real estate scams and shady tactics that target seniors, offering detailed insights on how to spot and avoid them. Specifically, we’ll look at:

Door-to-Door Service Contracts and Products

How it Works: The door-to-door contracts scheme begins when a ‘groomer’ shows up at a home making false promises, offering rebates or playing on the fears of an older homeowner. They use slick presentations and high-pressure sales tactics to coerce the homeowner to agree to overpriced, multi-year rental contracts registered on the home’s title or funded via high-interest mortgages. The services offered don’t align with the homeowner’s real needs; sometimes, the product or service doesn’t even exist! CBC’s Marketplace recently did a great investigative piece on this scam.

Avoidance Tips: Ontario made door-to-door sales of HVAC systems illegal in 2018, so if someone shows up at your door and wants to discuss your heating or cooling system, they are almost certainly scammers. Other useful tips to avoid the door-to-door services scam:

- Don’t feel pressure to agree to or sign anything on the spot – make sure you read and understand any contract completely before signing it

- Ask lots of questions

- If your spidey senses tingle, ask a trusted or family member for their opinion

- Be suspicious of the motives of anyone who shows up at your door uninvited (and yes, that includes real estate agents)

Fake Rental Listings

How The Scam Works: Scammers post fake rental listings to sites like Kijiji and Craigslist, tricking victims into paying deposits or sharing personal information. They steal photos from the internet – often from real homes listed for sale or rent – and price the home below market value. Once you’ve shared your information and deposit, POOF! They disappear, and so does your money.

How to Spot Fake Rental Listing:

- If it seems too good to be true…it probably is. Scammers prey on the very real frustrations of high rental prices in Toronto and post photos of a gorgeous home at an unbelievable price. The hope is that people will get so excited about the under-market price that they’ll move quickly to secure it without doing proper due diligence or taking notice of the red flags.

- The ‘landlord’ is often out of town – they give details about a sick relative or an overseas work trip

- The ‘landlord’ can only communicate by email – they may claim they have a disability that prevents them from being able to speak on the phone or meet in person.

- They ask for a deposit before you’ve seen the property – deposits should only be paid AFTER you’ve seen the property and have executed a lease.

- They ask for the deposit to be paid via cash, gift cards or via a money transfer company. Don’t ever send money to a landlord via Western Union.

- They make excuses as to why you can’t view the property – They’re sick, the keys are lost, they had to leave town unexpectedly… Never rent an apartment or house that you haven’t seen in person (or one that’s been viewed by a trusted REALTOR).

Illegal or Unenforceable Rental Clauses

How it Works: While this isn’t necessarily a ‘scam’, it happens way too often in Ontario: landlords taking advantage of seniors who don’t understand their rights. One of the most common ways they do that is by refusing to use the Ontario Standard Lease and, instead, inserting illegal or unenforceable clauses into a residential lease.

Some unenforceable or illegal clauses we regularly see:

- Damage deposits

- Agreements for above-average rent increases

- Illegal rent deposits

- Key deposits greater than the cost of the key

- Requirements to pay cleaning fees or maintenance

- Requirements for post-dated cheques or automatic withdrawals

- Requirements to give the landlord ‘general notice’ in accessing your suite

- Not allowing you to sublet or assign your lease

- Requiring you to renew a lease at the end of the initial 12-month lease ( in Ontario, all tenants are automatically considered ‘month-to-month’ tenants and can stay as long as they want, or provide 60 days’ notice that they are vacating)

- Restrictions on legal activities in your apartment

- Limitations on guests

- Restrictions on pets (unless the rules are from the Condominium Corporation, which trumps the LTA)

- Requiring you to be responsible for lawn care and snow removal (or worse, forcing you to pay THEM to do it)

- Trying to evict you because they are selling the property

- Requiring you to be responsible for maintenance and/or the cost of repairs

We wrote a VERY detailed blog about tenant rights in Ontario here.

Avoidance Tips:

- Educate yourself about your rights as a tenant

- Work with a REALTOR to secure a rental – they’ll ensure you don’t sign an illegal or unenforceable lease

Reverse Mortgage Scams

How it Works: Reverse mortgages allow homeowners to borrow money from the equity in their home, without having to sell it or make repayments until the homeowner moves out of the home, sells it or dies. While there are legitimate reverse mortgage companies in Ontario, there are also those looking to take advantage of seniors who need cash. Scammers offer fake reverse mortgage deals, promising cash in exchange for equity. Victims may end up losing their homes or equity.

How to Avoid:

- Choose your reverse mortgage provider carefully. Ask friends for referrals and read online reviews.

- Be suspicious if someone reaches out to you offering a reverse mortgage; only deal with companies you research and contact.

- Be wary of reverse mortgage companies that want you to transfer title (that’s not required) or ask for sensitive financial information.

- Don’t pay upfront fees for information or applications.

Title Fraud

How it Works: Title fraud is one of the most common real estate scams among seniors in Canada and involves the transfer of the title to your property to someone else without your knowledge or consent. It usually works in one of the following ways:

1 – Scammers use stolen or fake ID to pose as legitimate homeowners, taking out one or more mortgages on a property and pocketing the mortgage money, leaving the real homeowner with a mortgage they don’t even know about.

2 – Scammers register forged documents, allowing them to discharge any existing mortgages and transfer the property to themselves, register a new mortgage and take the money.

Here’s an article that explains title fraud in further detail.

Avoidance Tips:

- Safeguard your personal documents and secure your property records

- Don’t give out personal information on the phone, through mail or online, unless you know the person you’re giving it to. Avoid giving out your social insurance number (SIN).

- Don’t sign any document that you don’t fully read and understand

- Periodically, check the provincial land registry office to ensure the title of your home is still in your name (you can also ask your REALTOR to do this for you).

- Review your credit report every year to ensure there are no discrepancies. You can check your credit score with Equifax or TransUnion Canada.

- Watch your mail – Identify theft often starts when a fraudster redirects your mail and gets access to your personal information, so make sure to remove mail from your mailbox, pay attention to missing bills or mail and make sure to forward mail when you move.

- Consider purchasing title insurance

Home Improvement Scams

How it Works: In a too-common scam, shoddy home professionals promise home improvements but either don’t complete the work or overcharge for shoddy repairs.

In another home improvement fraud, the scammers show up at your door and tell you that you need emergency repairs – they’ll try to frighten you about a gas leak or other hazard and pressure you to hire them on the spot. The scammers then place a Notice of Security Interests (NOSI’s) on your property without your knowledge, binding you to a contract you must pay before you can sell or refinance your home.

Avoidance Tips: When hiring a home services professional, get multiple quotes. Ask friends and family for referrals and read online reviews. Most importantly, never pay a contractor in advance.

Be very cautious if someone shows up at your door uninvited and offers home services. Don’t give out any personal information, don’t sign any contracts and don’t give them any money. If you are, in fact, interested in what they are offering, ask for their contact information and tell them you’ll be in touch – then research the person and company online and ask a trusted friend or family member for a second opinion.

‘I Have a Buyer For Your House’ Scams

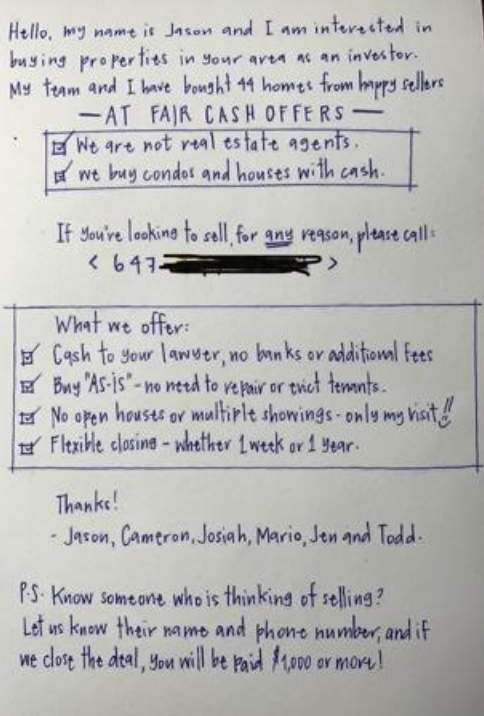

How it Works: Unscrupulous investors sometimes send letters to seniors, offering to buy their home without the hassles or expenses of listing it for sale. The letters appears to be handwritten and personal – but they are, in fact, sent to thousands of other homeowners. Make no mistake about it – they want to buy your home for less money than it’s worth (sometimes hundreds of thousands less).

True Story: In 2021: A GTA homeowner sold his home to one of these ‘cash buyers’ for $330,000; the property closed September 21. Ten days later, the home was re-listed for sale by the new owners for $399,000. They received 8 offers…and it sold for $580,000. Sure, the homeowner saved on commission…but it cost him a quarter of a million dollars!

Unfortunately, we sometimes see the ‘I Have a Buyer For Your House’ tactic used by shady real estate sales agents too: they show up at your door unannounced, tell you they have a buyer for your home and proceed to get you to sign a listing agreement. There isn’t usually a real buyer – this is just a way for them to build their business. If you want to sell your house, you’d be better served by hiring a top-rated agent who won’t use deception as a means of building a relationship with you.

Avoiding It:

- Throw out those letters! Trust me, it’s not the way to maximize the price of your home.

- Don’t sign a listing agreement without taking the time to research the agent, the value of your home and your goals. If it seems too good to be true…

High-Pressure Sales Tactics

How it Works: Beware the questionable home service professionals and REALTORS who use high-pressure tactics, often playing on emotions, to force seniors into quick decisions.

Avoidance Tips: Take your time, consult with trusted advisors, and never rush into agreements under pressure.

Tips for Avoiding Real Estate Scams

- Verify Professionals: Work only with licensed, reputable real estate agents, lenders, and inspectors.

- Seek Legal Counsel: Consult with a lawyer experienced in real estate matters before making significant decisions.

- Research Extensively: Investigate any offer, company, or individual thoroughly, and don’t be afraid to ask questions.

- Protect Personal Information: Never share sensitive personal or financial details over the phone or email.

- Know Your Rights: If you’re renting a property, make sure you understand your rights as a tenant in Ontario.

- Read Contracts Carefully: Review all contracts and documents meticulously before signing, seeking legal advice if necessary.

- Stay Informed: Keep abreast of common scams and educate yourself on recognizing and avoiding them.

- Trust Your Instincts: If an offer seems too good to be true or feels suspicious, trust your gut instinct and proceed with caution.